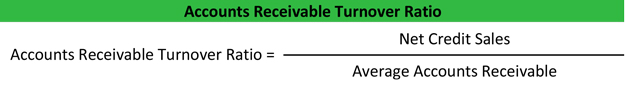

Step A: Obtain the average accounts receivables for the specific period. Divide the net credit by this value to get the required ratio. Then, divide this value by 2 to get the average accounts receivables for this specific period. To compute the accounts receivable ratio, first, you need to calculate the total of the accounts receivables at the beginning and the end of the given period. Businesses calculate these values over a given time.

#Receivable turnover ratio formula how to

How to Calculate Accounts Receivable Turnover Ratioīusinesses calculate the value of the Accounts Receivable Turnover Ratio by dividing the net sales from credit by the average value of accounts receivables. It also helps you understand if improved strategies need to be implemented for better credit risk management. Regardless of the payment terms, this ratio reveals the predictability of cash flow into a business. On the other hand, Business A faces the risk of bad debts – some customers may pay late while some may shut down, making the outstanding credit a loss. Business B may necessitate bill payment 30 days before a service/ product is delivered.īusiness B has better protection against payment defaults as it provides its product/ service only after bill fulfilment. Some businesses may require payment after a service or product delivery.įor example, Business A may offer a credit of 30 days starting a day after invoice generation for a product/ service delivered. For example, some businesses may require payment before the delivery of a service or product. Payment terms may be different for different businesses. If you have customer accounts with outstanding payments, the turnover ratio tells you how successful you have collected such payments.

Accounts Receivable Turnover Ratio in DetailĪlso referred to as Receivables Turnover, the Accounts Receivable Turnover Ratio specifies the count of credit collections per year by a business. Even if growth funding is not a priority currently, this ratio is important to understand your business’ efficiency in collecting outstanding credits. A good score is essential to attract investors if your business seeks credit. Accounts Receivable Turnover Ratio is a key metric for businesses.

0 kommentar(er)

0 kommentar(er)